News & Press

Changes to R&D Expensing—Unpleasant Surprise to Taxpayers and Great Opportunity for Bipartisanship

The Tax Cuts and Jobs Act of 2017 (TCJA) brought about the most sweeping update to the U.S. tax code since the 1986 tax reform enacted under President Reagan. The centerpiece of the TCJA, was a permanent reduction in the corporate tax rate from approximately 35% to 21%. The TCJA was also seen as favorable for the research and development (R&D) tax credit, keeping the credit permanent while a significant number of other credits and deductions were eliminated to pay for the lowered tax rates. In addition, the reduction in corporate tax rates also brought about a welcome increase in the value of the reduced R&D tax credit.

However, buried in the Act was a change to the treatment of tax code Section 174 deductions starting with tax years beginning after Dec. 31, 2021. Pre-TCJA, Section 174 provided taxpayers with the option of immediately expensing R&D expenditures under Section 174(a) or electing under Section 174(b) to treat these expenditures as deferred expenses and amortize the costs over a period of not less than 60 months beginning with the month that the taxpayer first realizes benefits from those expenditures. This allowed taxpayers tax planning options to either utilize the deductions in the current year, or to defer them depending on their facts and circumstances. In addition, under Section 174(f)(2), taxpayers could elect under Section 59(e) to amortize over 10 years expenditures otherwise allowed as a deduction under Section 174(a).

For tax years beginning after Dec. 31, 2021, the new legislation in the TCJA eliminates the option to deduct R&D expenditures currently and requires taxpayers to charge them to a capital account and amortize them over five tax years, beginning with the midpoint of the tax year in which the specified research or experimental expenditures are paid or incurred (Section 174(a)). The amended Section 174 requires the extended amortization even in cases of a retired, abandoned, or disposed property for which specified research or experimental expenditures are paid or incurred, thereby denying an immediate deduction in the case of retirement, abandonment, or disposal. As an additional blow, for foreign research, the amortization period is extended to 15 tax years.

Taxpayers that utilized Revenue Procedure 2000-50 to either expense software development costs or amortize them over 36 months are out of luck as well. The new language in Section 174(c)(3) states that any amount paid or incurred in connection with the development of any software shall be treated as a research or experimental expenditure, forcing it into the five-year amortization period.

Given the imminent changes coming in 2022, taxpayers should start to develop tax planning strategies to minimize the negative impacts due to the new amortization rules. In prior years, many taxpayers have been able to expense costs incurred under either Section 162 for ordinary and necessary business expenses or under Section 174(a) without major tax consequences. Starting with 2022, taxpayers will have to pay close attention to the characterization of the expenses between the two code sections due to the new timing differences. To the extent costs cannot be included for the R&D tax credit under Section 41, they should also be reviewed if they can also be excluded for Section 174 based on the definitions found in Treasury Regulation 1.174-2 to expense these amounts in the year incurred under Section 162.

In addition, the amended Section 174 may impact companies that have never taken the R&D tax credit previously due to net operating losses (NOLs) or funding issues. These taxpayers will now be forced to determine whether their costs incurred should be amortized instead of expensed.

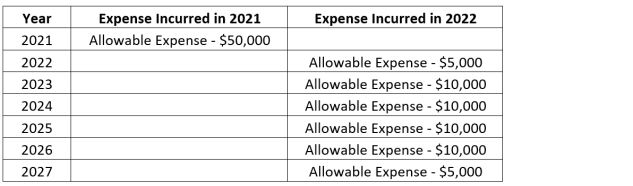

Due to the delayed effective date of the modifications to Section 174, taxpayers still have a short window of opportunity to continue to take advantage of the current expensing of research or experimental expenditures under Section 174(a). Consequently, taxpayers with planned R&D activities should consider expediting those expenditures to before 2022. While the taxpayer incurs these expenses a year earlier, in many cases, the immediate deduction can offer significant time value of money savings. Consider the chart below, illustrating the treatment of a $50,000 Section 174 expense incurred in 2021 and 2022:

Taxpayers should also reconsider the allocation of R&D activities in the U.S. and foreign jurisdictions. While offshore locations are often touted for having cheaper labor compared to the U.S., the changes to the Section 174 offer compelling reasons for the relocation of R&D activities. By conducting R&D activities in the U.S., the amortization period is reduced from 15 years down to five years. In addition, by moving activities to the U.S., the expenses may be eligible for the R&D tax credit, adding to the funds available for future discoveries.

While taxpayers and tax advisors are still focused on compliance for the 2020 tax year, it would be prudent for them to consider the implications of the upcoming changes to Section 174. Taxpayers should be prepared to deal with higher taxable income in 2022, as 90% of Section 174 expenses are tax deferred into future years compared to being completely expensed previously. To the extent that acceleration of R&D expenses into 2021 makes business sense, those costs would have preferential treatment for most taxpayers than if incurred in 2022.

There are currently legislative proposals in Congress to modify the imminent onerous changes in Section 174 rules. A Senate bill released March 16, 2021, The American Innovation and Jobs Act, which was introduced by Sens. Margaret Hassan (D-N.H.), Todd Young (R-Ind.), Catherine Cortez Masto (D-Nev.), Rob Portman (R-Ohio), and Ben Sasse (R-Neb) would allow companies to claim the full research and development tax deduction immediately in one year under Section 174. It would eliminate a provision in the 2017 Tax Cuts and Jobs Act that starting in 2022 requires companies to spread out research and development deductions over a five-year period. This bill is a great opportunity to demonstrate bipartisanship.

A similar bill was introduced on Feb. 24 in the House by Representatives by Reps. John Larson (D-Conn.), Ron Estes (R-Kan.), Jimmy Panetta (D-Calif.), Darin LaHood (R-Ill.), Suzan DelBene (D-Wash.), and Jodey Arrington (R-Texas ). Lawmakers on both sides want to achieve a deal on R&D expensing and it would prove helpful if a deal could be achieved prior to the last minute dash that occurs in a year-end deal. Everyone realizes the benefits of successfully addressing this issue, as resolving this successfully could continue to assist an economic recovery, as the economy exits the pandemic.

One key lesson of the Covid-19 pandemic of 2020/2021 is the need to reevaluate the U.S. supply chain, so that we are not overly dependent on any one country. One of the best weapons to achieve that is to catalyze growth in U.S. R&D in STEM and manufacturing. As research and development is the most powerful way to invest in and strengthen future economic growth, this legislation should be welcomed by all. Bolstering research and development will foster the development of game changing technologies and capabilities strengthening future economic growth. This legislation should be welcomed by all.