Articles & Alerts

Understanding and Mitigating Fraud: Strategies for Non-Profits

Fraud remains a pervasive threat to organizations globally, as highlighted by the ACFE Report to the Nations. The report analyzed 1,921 fraud cases, with non-profit organizations accounting for 10% of the total number of cases and thus underscoring that fraud affects entities across various sectors indiscriminately. The total losses revealed across the over 1,900 cases amounted to a staggering $3.1 billion. While non-profit organizations experienced median losses of $76,000—significantly lower than other sectors—they face unique challenges in implementing robust fraud prevention measures.

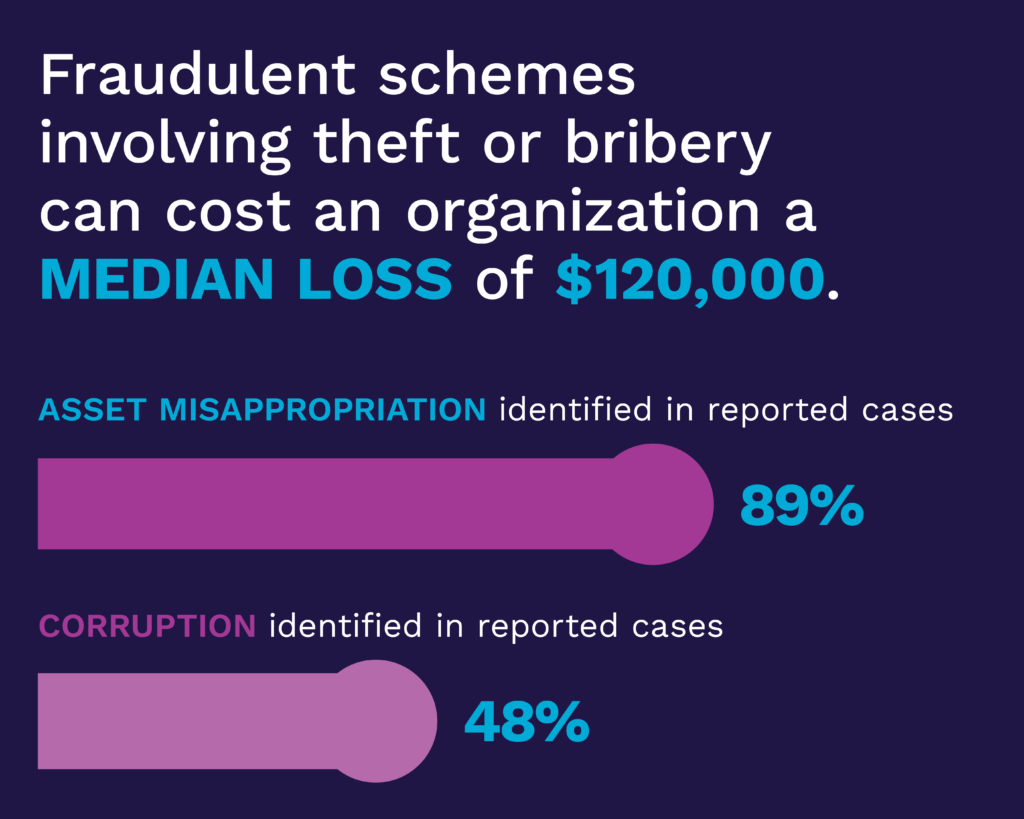

The report identified asset misappropriation as the most common form of fraud, comprising 89% of cases. These schemes typically involve the misuse or theft of an organization’s resources, with a median loss per instance amounting to $120,000. Additionally, corruption was identified in 48% of reported cases, highlighting the prevalence of schemes involving bribery or conflicts of interest within organizations.

Non-Profits’ Biggest Challenges & Priorities

Detecting fraud remains a significant challenge, with the average scheme lasting approximately one year before discovery. This delay underscores the importance of proactive monitoring and stringent internal controls to identify irregularities promptly.

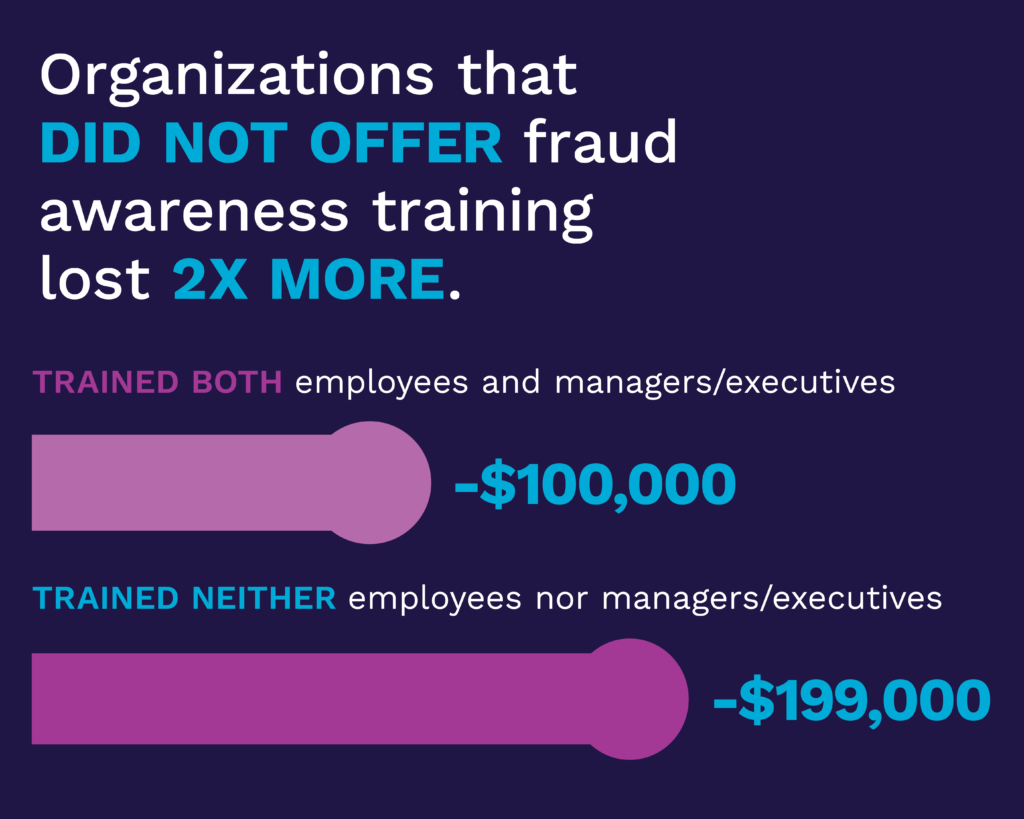

Despite the advantages of stringent controls, non-profits frequently encounter challenges when implementing thorough fraud prevention strategies. The sector’s lower median loss figure highlights the necessity for improved awareness and training programs that align with specific operational contexts. Organizations that do not offer fraud awareness training reported double the financial losses compared to those that do provide such training. Specifically, organizations that provided training to both employees and managers/executives experienced median losses of $100,000, while those that offered no training at all reported losses nearly double, at $199,000. Organizations that prioritize anti-fraud controls such as codes of conduct, external audits, and management certifications are better equipped to mitigate fraud risks and minimize financial losses.

The ACFE Report provides valuable insights into the dynamics of fraud, emphasizing the critical role of proactive measures in safeguarding organizations. By understanding common fraud schemes, enhancing detection capabilities, and fostering a culture of vigilance, both businesses and non-profits alike can effectively combat fraud and protect their assets and reputations.

Reach out to Brian Sanvidge, Principal & Leader of Anchin’s Regulatory Compliance & Investigations Group, or your Anchin Relationship Partner, if you are interested in enhancing your organization’s fraud prevention measures.