Articles & Alerts

Qualified Small Business Stock: What is it and Why is it Valuable?

Written by: Marlen Preyger, Director

In today’s volatile investment landscape, savvy investors are laser-focused on optimizing their return on investments. It’s a strategic dance where maximizing returns meets minimizing potential tax leakage. For entrepreneurs navigating this terrain, the goal is clear: attract investors, incentivize employees, and lure top-tier talent into the fold. Favorable corporate tax rates, coupled with the tax advantages offered for Qualified Small Business Stock (QSBS), emerges as a potent tool for achieving these objectives. These factors remain pivotal when shaping the structure of new businesses, making them crucial considerations for any thoughtful business formation strategy.

QSBS – The Basics

The Internal Revenue Code allows non-corporate taxpayers to exclude from income a certain percentage of gain derived from the sale or exchange of QSBS, limited to the greater of $10M or 10x the taxpayer’s adjusted basis.

To qualify as QSBS, the:

- Entity must be a domestic C-corporation;

- Holder must have held the stock for more than 5 years at the time of sale;

- Gross assets must not exceed a value of $50,000,000 at any time on and before the issuance of the stock;

- Stock is required to be acquired at original issue and not from the secondary market;

- Entity must use at least 80% of its assets in the active conduct of one or more qualified trade or businesses; and

- Exclusion is only available to non-corporate taxpayers.

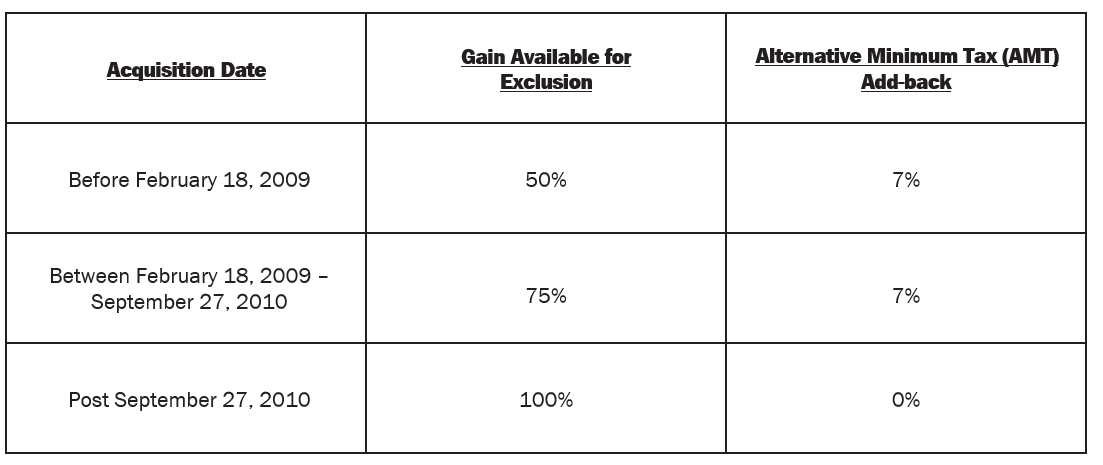

For those meeting the above criteria, the amount of the gain excluded from tax depends on the acquisition date of the stock:

Other Considerations

The information disclosed above provides a simple introduction into QSBS, but there are other considerations that should be accounted for, including:

- An addback of a portion of the excluded gain for AMT purposes.

- The gain exclusion is limited to the greater of $10 million or 10 times the taxpayer’s adjusted basis.

- QSBS applies to both common and preferred stock.

- QSBS regulations possess a look-through rule, where the qualified business requirement will be satisfied through a subsidiary corporation that is at least 50% owned.

- Many states conform to the federal rules; however, some do not.

- Taxpayers can potentially increase the $10 million gain exclusion amount by dividing an issuer’s shares among multiple “taxpayers,” such as non-grantor trusts.

Redemptions – Be Aware

Buried within the QSBS provisions are anti-abuse rules codified to ensure taxpayers follow congressional intent of this tax incentive. For example, C corporations engaging in redemptions may risk losing this capital gain exclusion benefit for their investors. A C corporation that redeems stock from an existing shareholder can potentially taint the qualified small business stock status of that existing shareholder. Furthermore, if a C corporation enters into a “significant redemption transaction” they can risk losing the qualified small business status for all investors that were issued stock within a two year before and after the redemption. However, with proper planning techniques, taxpayers as well as investors can ensure that their gain exclusion remains intact.

For more information on QSBS and how it can be leveraged for your business investments, please contact Chris Noble, Partner and Co-Leader of the Technology Group, Adam Pizzo, Partner and Co-Leader of the Technology Group, or your Anchin Relationship Partner.