Articles & Alerts

The Mergers and Acquisitions Market is Bouncing Back!

Deals are back in full force! Global M&A activity through May 2021 was over $1.0 trillion, compared to just $550 billion over the same period in 2020.

The information technology (IT) and healthcare sectors led the overall deals announced. Notable deals in IT include Microsoft’s acquisition of Nuance Communications for $19.7 billion in April of 2021 and Hitachi’s $9.6 billion acquisition of GlobalLogic announced in March. A notable healthcare sector deal was the Optum’s $13.7 billion acquisition of Change Healthcare Inc.

While the overall M&A market is driven by these large deals over $5 billion, the middle market* is also thriving, with dealmakers getting more comfortable conducting deals both virtually and in person. In the second quarter of 2021 alone, the market has seen around $32 billion in middle market mergers and acquisitions, driven primarily by the real estate/infrastructure, healthcare and energy sectors, which accounted for around 31% of these deals.

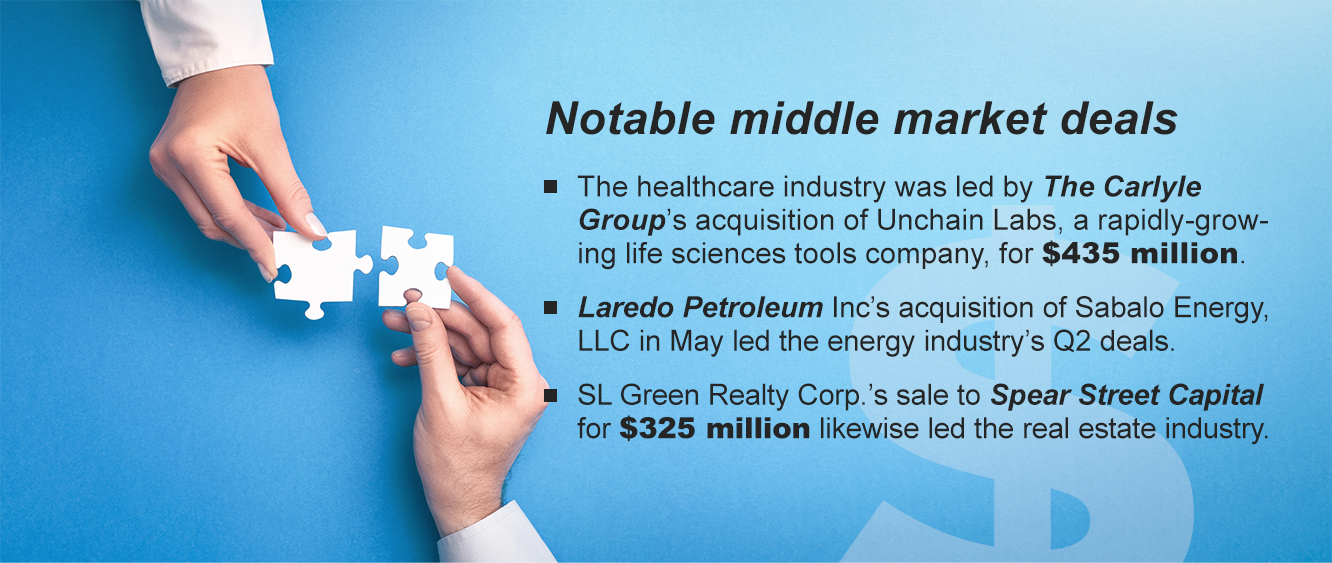

The healthcare industry was led by The Carlyle Group’s acquisition of Unchain Labs, a rapidly-growing life sciences tools company, for $435 million. Laredo Petroleum Inc’s acquisition of Sabalo Energy, LLC in May led the energy industry’s Q2 deals. SL Green Realty Corp.’s sale to Spear Street capital for $325 million likewise led the real estate industry.

This shift in M&A activity comes as vaccine rollouts, extensive monetary policy support and rapid innovation have allowed companies to navigate the uncertainty better than expected. We expect increased activity throughout 2021. Furthermore, this resurgence in M&A deals is driven by private equity investments and popularity of other investing vehicles such as special purpose acquisition companies (SPACs).

* $100 – $500 MM