Articles & Alerts

The Latest Updates on the Paycheck Protection Program Flexibility Act and the Main Street Lending Program

Late Monday, the SBA and Treasury issued a joint press release that was followed by a press release from the Federal Reserve (“The Fed”). The SBA and Treasury promised to respond to the Paycheck Protection Program Flexibility Act (PPPFA) with the prompt issuance of rules and guidance, a modified borrower application form, and a modified loan forgiveness application form. We do not yet know the timing of these items. The release goes on to summarize the key changes in the PPPFA. Also, the following declarations that are not specifically in the Act were made by the SBA/Treasury:

- The new rules will confirm that June 30, 2020 remains the deadline to receive approval of a PPP loan application

- The effective date of the new five-year loan term is for loans approved by the SBA on, or after, June 5, 2020

- The new 60% threshold for payroll costs is NOT a cliff. If a borrower’s payroll costs make up less than 60% of total eligible costs during the covered period, they will be eligible for an amount of loan forgiveness that will be less than their full loan amount. This is because at least 60% of the forgiveness amount must be comprised of payroll costs.

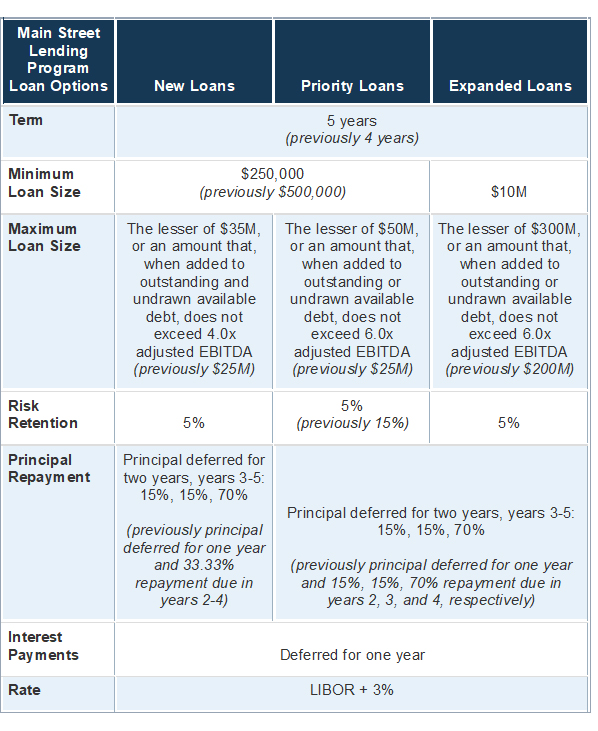

Also, the Fed expanded its Main Street Lending Program once again. Key changes are to lower the minimum loan amount from $500,000 to $250,000, raise the maximum loan size, reduce lenders’ retained risk on Priority Loans, defer all principal payments for two full years and extend the loan terms to five years. The Fed expects the Main Street program to be open for lender registration soon and to be actively purchasing loans shortly thereafter.

Here is the new chart from the Fed showing the key changes:

While these changes are the latest to date, we anticipate additional guidance over the coming weeks. We will continue to monitor ongoing updates to the PPP Program and Main Street Lending Program. To better understand how the changes impact your unique situation, please contact your Anchin Relationship Partner or our Anchin COVID-19 Resource Team at [email protected].

Disclaimer: Please note this is based on the information that is currently available and is subject to change.