Articles & Alerts

Protecting Your Business By Managing Payment Card Industry (PCI) Compliance in the Digital Age

The digital age has made small business merchants the new hot target for financial fraud. By taking advantage of lax security on a small business’ data from payment card transactions and processing systems, cybercriminals can steal and use personal consumer financial information. If your payment card data is breached, the fallout can be immediate, as customers lose trust in your ability to protect their personal information.

Your customers’ card data is a gold mine for criminals, which is why any business that stores, processes or transmits cardholder data must make sure they are in compliance with the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS is a set of security requirements that can help merchants protect customer card data located on payment cards, and applies to all entities involved in payment card processing—including merchants, processors, acquirers, issuers, and service providers. The standards also apply to all other entities that store, process or transmit cardholder data (CHD) or sensitive authentication data (SAD).

While difficult to navigate, there are a few steps that businesses can take to protect themselves while on the road to PCI DSS compliance.

Start with a Self-Assessment Questionnaire

Merchants may be familiar with validating their PCI DSS compliance via the Self-Assessment Questionnaire (SAQ). The SAQ includes a series of yes-or-no questions for each applicable PCI DSS requirement. If any of the answers are no, the organization may be required to state the future remediation date and associated actions.

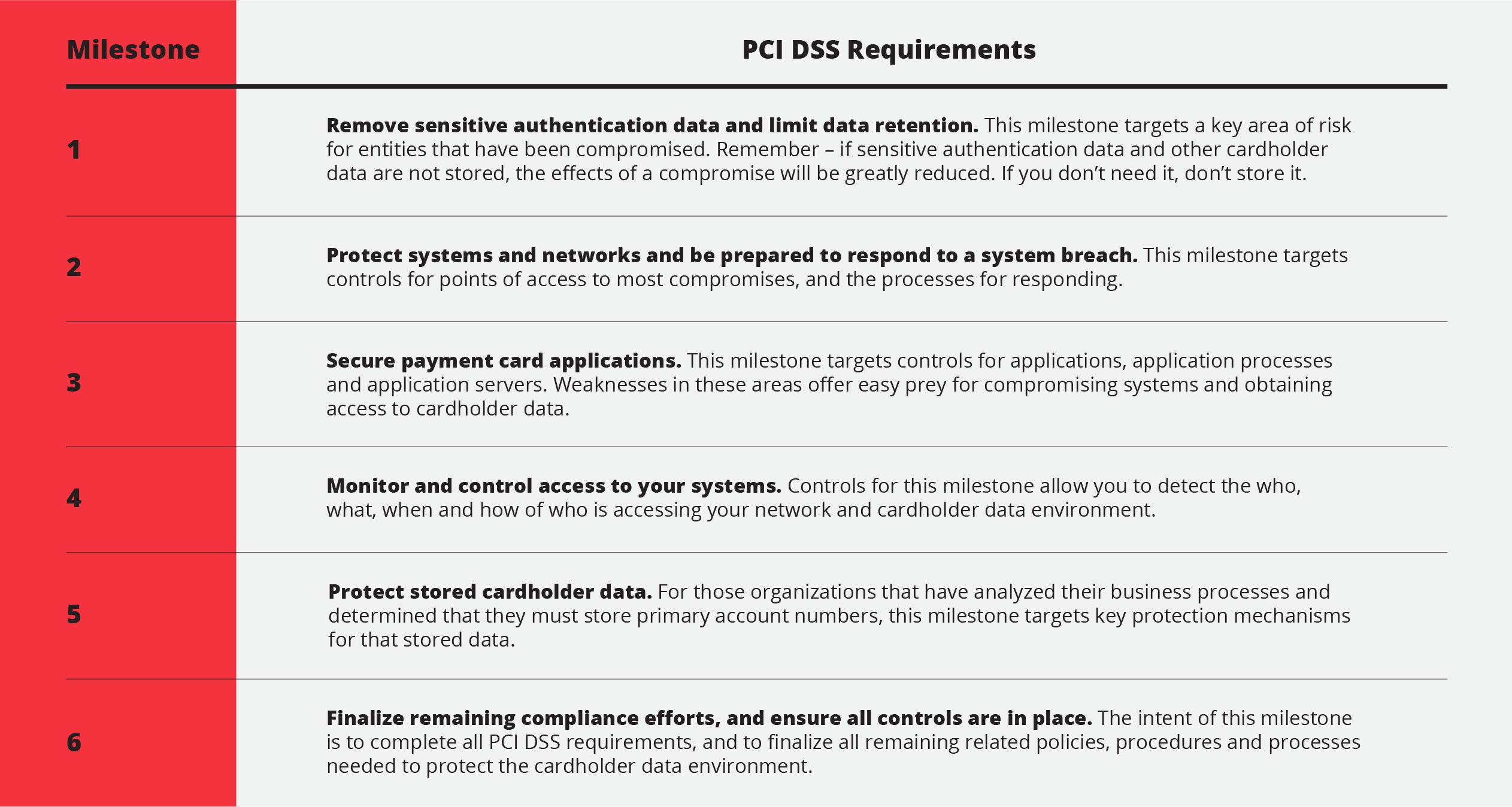

The Prioritized Approach

The prioritized approach provides a roadmap of six security milestones that can help merchants and other organizations incrementally protect against the risk associated with storing, processing or transmitting cardholder data while on the road to PCI DSS compliance. This approach is not a substitute, shortcut or stop-gap approach to PCI DSS compliance; rather, it will help small businesses understand what steps they should take to reduce risk as early as possible in the PCI DSS compliance process.

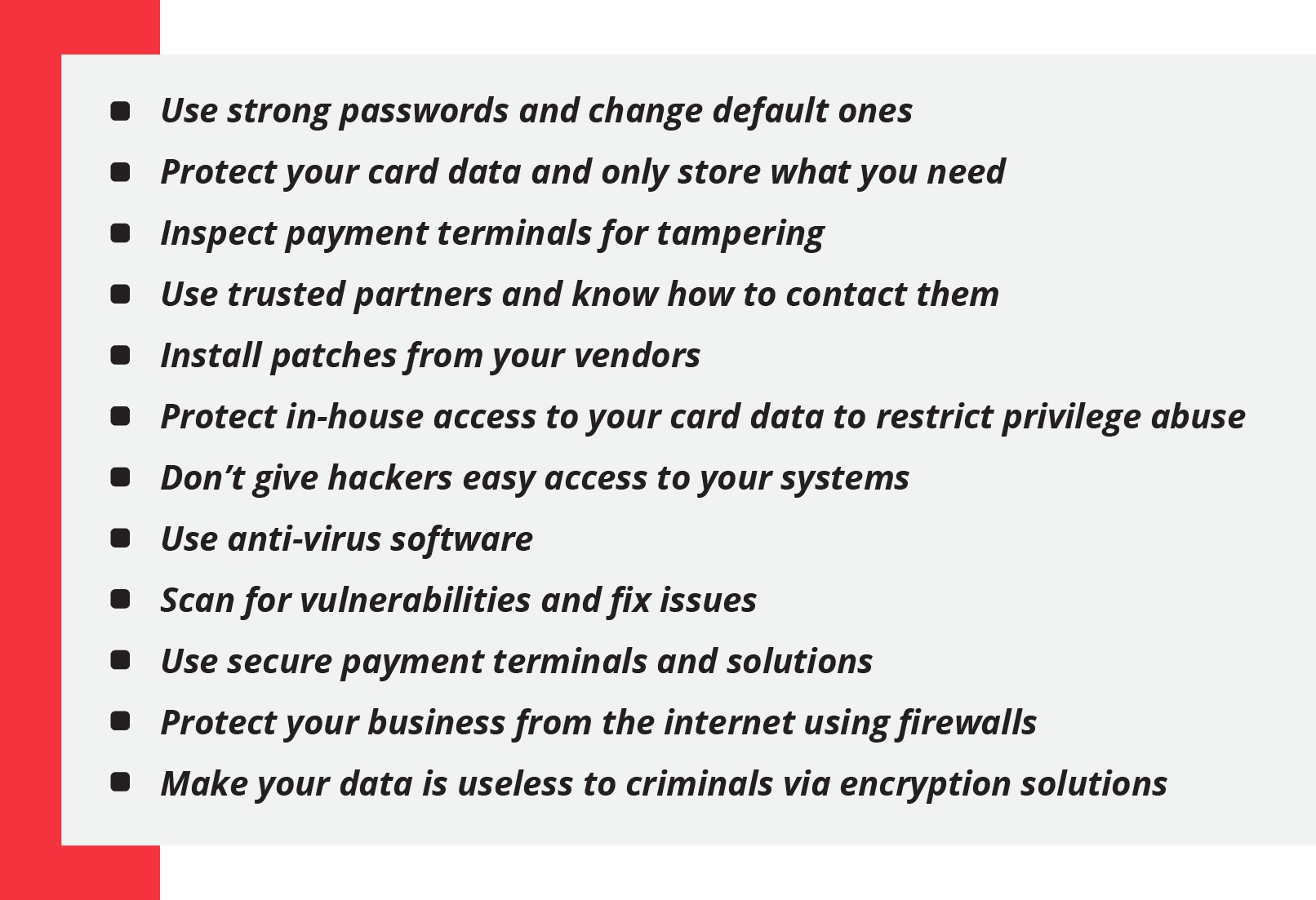

Recommended Protections to Put In Place

If you are interested in assessing your PCI compliance, please reach out to Russell Safirstein, Partner in Charge of Anchin Digital Risk Solutions (ADRS) and President of Redpoint Cybersecurity, or your Anchin Relationship Partner.