Articles & Alerts

Preserving Your Family Legacy with Spousal Lifetime Access Trusts (SLATs)

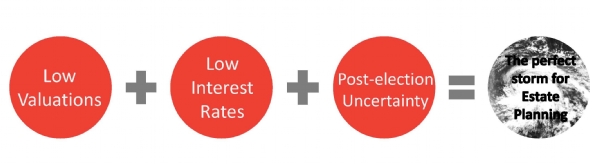

We are currently experiencing a perfect storm for estate planning – a historically high Federal gift tax exemption coupled with depressed values, largely attributable to the pandemic. A married couple has the ability to transfer up to $23 million out of their estate with no gift tax payable. This exemption is scheduled to be reduced by half in five years, or sooner, through new legislation. While taking advantage of this significant estate planning opportunity is very appealing, many people are reluctant to part with this level of assets. Fortunately, there is a vehicle which allows for assets to be transferred to a trust, removing them from the estate, while still allowing access if needed.

The Spousal Lifetime Access Trust (SLAT) serves to use the lifetime gift tax exemption, while still providing the ability, should the need arise, to access the gifted assets. To illustrate the concept, suppose Spouse A creates a trust for the benefit of the other spouse, Spouse B, and possibly their children. The trust allows for distributions to Spouse B during such spouse’s lifetime, after which time the trust continues for the benefit of the children. Spouse B would create a similar trust for the benefit of Spouse A and the children. In good times, the couple would use and enjoy assets outside the SLATs. But should there be a reversal of fortune in the lives of A and B, there is the ability for them to receive distributions from the trusts for their benefit. While any such distributions would bring assets into the estate that were previously removed, this could be done where there was a need for these assets.

The income from a SLAT is taxable to the creator of the trust, whether or not there are distributions to beneficiaries. The creator’s payment of the trust’s tax might seem like an additional gift to the trust, but IRS rules do not count it as such, making this feature an added benefit.

This strategy also allows for the trusts to continue after the death of the beneficiary spouse for the benefit of the children and grandchildren, who may receive distributions from the trust during their lifetimes. In this case, it is possible to avoid having the trust taxed in the estate of these beneficiaries upon their deaths, providing the creator of the trust with the opportunity to do multi-generational planning.

To discuss how a Spousal Lifetime Access Trust (SLAT) could be relevant for your estate plan, or if you have any questions on Trust & Estate matters, please contact your Anchin Relationship Partner or E. Richard Baum, a Tax Partner in Anchin Private Client at 212.840.3456.