Articles & Alerts

New Jersey’s State and Local Tax (SALT) Cap Opportunity

On January 13, 2020, New Jersey enacted the Pass-Through Business Alternative Income Tax (the “NJPTBA tax”) Act, effective for tax years beginning on or after January 1, 2020. This represents a State and Local Tax (SALT) cap workaround (similar to legislation already in place in Connecticut), that provides an opportunity to workaround to the Federal state tax deduction limitation of $10,000 (the “SALT cap”) passed under the Tax Cuts and Jobs Act (TCJA) in late 2017.

For New Jersey purposes, income and losses of a pass-through entity are passed through to its owners. However, the new law allows pass-through entities to elect to pay the New Jersey tax due at the entity level (as a deductible business tax) on the owner’s share of distributive income. The owner(s) may then claim a refundable tax credit for the amount of tax paid by the pass-through entity on their share of distributive income. The result is a potential deduction for the amount of New Jersey income tax that may have otherwise been limited.

Pass-through entities included under this new law are partnerships, Federal S corporations that have made the New Jersey S corporation election, and limited liability companies, with at least one member who is liable for tax on their share of distributive income under the New Jersey gross income tax. Single member limited liability companies and sole proprietorships may not elect to pay the NJPTBA tax. Distributive income is defined as the net income, dividends, royalties, interest, rents, guaranteed payments, and gains of a pass-through entity, derived from or connected with sources within the state of New Jersey.

The election must be made each year by all owners of the pass-through entity or by an officer or member who is designated under the law or the entity’s organizational documents with the authority to make the election for all members. The annual election will be made on or before the original due date of the entity’s return on forms prescribed by the New Jersey Division of Taxation. The pass-through entity’s tax return is due on the 15th day of the third month after the close of the tax year. Estimated tax payments are due on April 15, June 15, and September 15 of the tax year and on or before January 15 of the succeeding tax year.

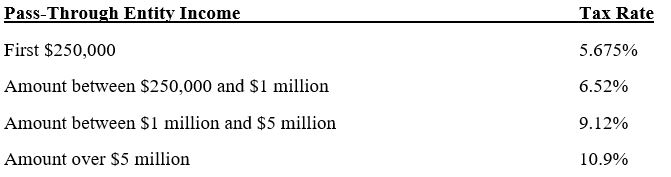

The tax rates under the NJPTBA tax are as follows:

Individuals, estates, and trusts receive a credit against their gross income tax equal to the member’s tax on the share of distributive income paid by the pass-through entity. Nonresident members of a pass-through entity making the NJPTBA tax election can still participate on a Form NJ-1080-C composite return and take a credit for taxes paid.

Corporate members are allowed a credit against the corporation’s business tax equal to the corporate member’s tax on the share of distributive income paid by the pass-through entity. The credit may not reduce the tax liability below the statutory minimum tax. Excess credits may be carried forward for twenty years.

The treatment of such an election for Federal income tax purposes is uncertain and may be challenged by the Internal Revenue Service (the “IRS”) in the future. Last year, the IRS said it planned to issue guidance on applying the SALT cap to pass-through entities, but nothing has been issued to date. In June 2019, the IRS issued regulations disallowing a federal deduction for donations to charitable gift trust funds to taxpayers who receive state tax credits for those donations. Further, non-New Jersey resident partners of an entity that elects to pay the New Jersey income tax at the entity level may not receive a credit in their home state(s) for the New Jersey tax paid, which would result in double state income taxation.

Prior to making this annual election, pass-through entity owners should thoroughly discuss the options and assess whether making the election in the current year will result in a more tax effective outcome for them. Please contact your Anchin Relationship Partner at your earliest convenience. We stand ready to help you plan effectively and to navigate through these new rules and reporting requirements. In the meantime, we will continue to update you as more information becomes available.