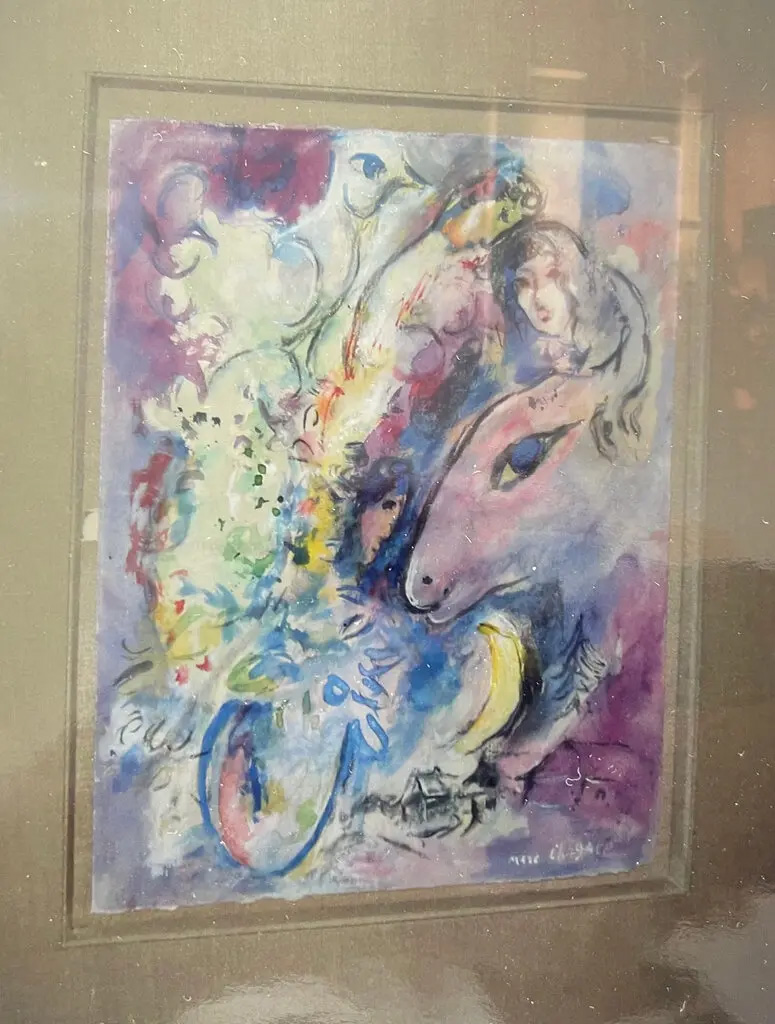

Art as an Alternative Asset Class: Considerations for Proper Risk Management to Avoid Catastrophic Loss

As passion investments of art, jewelry, wine, vintage automobiles, and other private collectibles continue to attract buyers of all generations, it’s important for collectors and their trusted advisors to understand how best to develop a robust insurance and risk management plan, because not protecting collections from unforeseen losses could have catastrophic consequences on the portfolio’s value.

At a recent art event, Anna Brusco, National Product Development Leader with Marsh McLennan Agency Private Client Services and its insurance company partner, Treadwell Fine Art & Collections Underwriters, shared some art industry statistics and market trends.

Here are a few takeaways from the conversation:

- Investment in the art market has grown over $50B from $20B in 2003 to over $70B in 2022.

- 32% of individuals with a net worth of greater than $10M collect art.

- It is estimated that between $2 – $4 Trillion of art is held in private collections.

- UHNW individuals spend on average between 3-11% of total net worth on Art; their collections are often their largest asset class.

- Collections are increasingly viewed as viable alternative asset classes by wealth managers.

- The art-secured lending market is projected to be worth $31.3B in 2022, up 11% year over year.

- The online art market has fueled growth, and in 2022, online art sales were approx. $20B dollars. Buyers have easy access to an incredibly broad array of collectible objects. Examples of the range of items include a laptop infected with six notorious viruses that sold for $1.3M and a Chinese vase that was estimated at $400 which sold for $812,500.

While some collectors acquire items due to a passion for their collectibles, aesthetic or decorative purposes, others invest for asset diversification purposes. Based on art market trends over the last several years, returns on these investments have skyrocketed. Some examples of recent 10-year period returns include whiskey, with values up 383%, vintage autos, with values up 185%, watches, with values up 147%, and wine, with values up 162%.

Auction sales for private collectibles also continue to amaze:

- Paul Newman’s Rolex watch was sold for $17 million by an ex-boyfriend of Newman’s daughter after Newman received the watch from his wife decades earlier.

- A copy of the U.S. Constitution sold for $43M, and a Bible is expected to become the most expensive book ever sold when auctioned at Sotheby’s this spring for an estimated $50M.

- Beeple’s NFT entitled “Everydays: The first 5,000 Days” sold for $69M in 2021.

- A 1952 Mickey Mantle baseball card sold for $12.6M in 2022.

It is critical for collectors to engage the right professional team to ensure that collections are not at risk for losses that can diminish their value. Some common considerations include proper valuation, display, location, geography, loaning/consigning frequency, transit exposures, storage exposures, and trust/tax ramifications.

Insurance policies covering private collectibles are usually issued on an “all risk” coverage basis and generally provide coverage for physical loss or damage due to flood, fire, theft, partial damage, hurricane, wildfire, earthquake, accidental damage, and mysterious disappearance. Most insurance company losses are due to accidental damage or damage in transit, and both are losses that can be prevented with a strong risk management plan in place.

Private collectors may benefit from investing in a stand-alone Private Collections insurance policy, which is specifically designed to cover the exposures outlined above. While homeowners insurance policies typically provide some coverage for private collections, often the coverage limits are too low, the coverages provided are more restrictive in nature and they are often subject to deductibles.

Additionally, updated valuations and appraisals are very important. Collectors should consider the following:

- Keeping appraisals and valuations updated on a regular basis (every few years).

- Maintaining a detailed inventory of the collection in a safe location away from the home.

- Instituting an emergency plan in the event of unforeseen circumstances, including ways to evacuate the collection from harm’s way, and a list of pre-vetted professionals to assist with the move and transfer.

Finally, private collectors should work with experts who can ensure proper risk management through effective programs for valuable collections and provide flexible and specialized coverages to protect all categories of investments of passion. For more information, or to discuss these or other related matters in greater detail, contact your Anchin Relationship Partner or Gilad Rand, a Director in Anchin’s Private Client Group.